|

Much as we would like to imagine an elderhood free from troubles, the truth is, we are all likely to need help eventually. And on several levels.

Informal support. This is the kind of help that friends and family members can provide short term. Someone to run errands or mow the lawn, etc. Make a list of the

When the going gets tough. If you were hospitalized, who would you call to

Your health care team. Medically trained support:

Professional advisors

An Aging Life Care™ Manager. The choices are boggling when it comes to assembling your team. It's difficult to assess quality of professionals or compare pricing. An Aging Life Care Manager is a "meta-advisor" whose experience can help you choose your team wisely and coordinate whom to call when. Want help assembling your team? Give us a call at 203-826-9206. Learn more about our aging life care planning services.

0 Comments

How you pay for care at home depends on whether the service is by medically trained staff or by nonmedical caregivers. Also, what you can mix and match in terms of community programs and help from friends and family.

Medicare pays only for care in the home that requires the skills of a nurse, nursing assistant, physical therapist, or other medically trained professionals. Home care $$–$$$$ The cost of nonmedical home care is NOT covered by Medicare. As a result, you must contract directly with providers. Fees depend on how many hours a week your care requires. Consider that caregivers coming to your home need a livable wage. Add to this agency costs of staff recruitment, vetting, training, and scheduling. The price can mount up quickly.

Adult day care $–$$$ You must pay privately. Many programs are run by nonprofits so are underwritten by donations and grants. Medicaid, LTC insurance, and veterans benefits may also help. Home health and hospice $

We can help you sort out your options. Give us a call at 203-826-9206. Learn more about our aging life care planning services. Judy fell and broke her hip. She calls 911. She lacks a medication list. As a result, the hospital team is unaware of her chronic conditions. Her daughter lives far away and doesn't know if she should fly in.

Accidents by their very nature are unplanned. That doesn't mean you need to be unprepared for a fall or a serious incident (e.g., a heart attack or stroke). Those who are prepared and have a professional advocate, such as an Aging Life Care™ Manager, are more likely to get the care and the outcomes they desire. Plus, they can recuperate in a setting most in line with their personal needs and preferences. To be prepared, you need

Ideally, all this information is available on your person or is readily accessed should you get into an emergency situation. Want help getting prepared for a medical emergency? Give us a call: 203-826-9206. Learn more about our aging life care planning services. Imagine your life as a movie. If you are the director, an Aging Life Care Manager is your production manager.

He or she is a deeply knowledgeable guide (usually a nurse, social worker, or allied professional) who finds you high-quality help, arranges care "locations," and advises you about needed services. Aging Life Care Managers are part of a national organization with training requirements, codes of ethics, and a nationwide network of experienced colleagues in case you need to move to a different part of the country. Specialized knowledge and skills Aging affects all aspects of life, so an Aging Life Care Manager draws upon many areas of expertise:

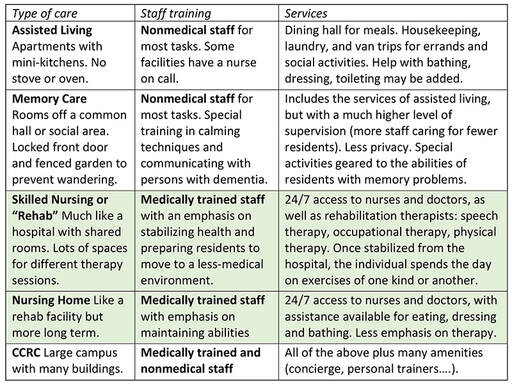

As the director of your later years, how do you want your story to unfold? While not all of it is within your control, you do have agency. With planning, there is much you can do ahead of time to prepare for the elderhood you want and create a network to support it. Would you like a guide for aging well? Give us a call at 203-826-9206. Learn more about our aging life care planning services. While “aging in place” has its benefits, it is expensive to get such individualized care. Plus, it’s rather isolating. Group options require a move, but are more social and cost effective.

Learn more about our aging life care planning services. |

AuthorLeslie Alin Tewes is a Geriatric, Disability & Medical Care Manager; Elder and Adult Care Advocate; Quality Improvement Specialist. Archives

July 2024

Categories |

RSS Feed

RSS Feed